^ "Could be more secure, and if so, how?".^ "ING Direct Launches 'Read-Only' Access Codes for Financial Aggregation".Archived from the original on May 11, 2010. "Intuit To Acquire (Former TechCrunch50 Winner) Mint For $170 Million". ^ Arrington, Michael (September 13, 2009).Mint does make a small referral fee from advertisers on some offers. ^ "How Mint's SmartSave Savings Engine Works"."Mint is Worth A Mint: $140 Million Valuation". ^ Arrington, Michael (September 2, 2009).

#Quicken mint integration series#

"Full Details On Mint's $14 Million Series C Round". "Mint, online money manager, raises $4.7M". " rakes in $14 Million in third round of funding". Over this decade, we've grown to include over 20 million users! ^ "Mint by the Numbers: Which User Are You?"."Using Intuit's Technology Doubles Bank Access, Completes Users' Experience". ^ Martha, Shaughnessy (19 April 2010).^ a b "Intuit Completes Acquisition of ".^ " Now Tracks Cash and Pending Transactions"."Yodlee no longer powers 's data aggregation tools". ^ "Can Mint be used outside of the U.S.?".^ "Everything You Wanted To Know About Startup Building But Were Afraid To Ask".It was also agreed Intuit would never sell Chase’s customer data.

#Quicken mint integration software#

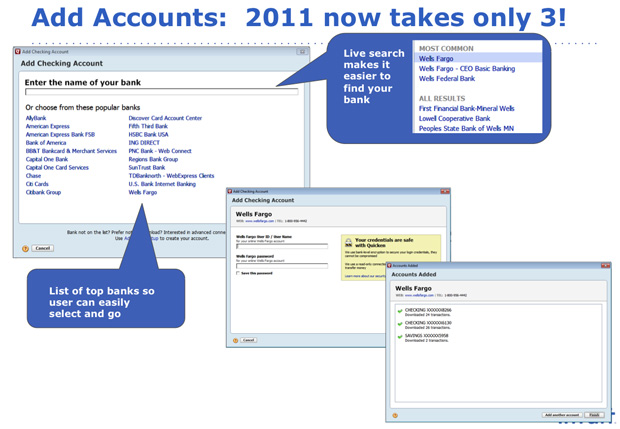

In January 2017, Intuit and JPMorgan Chase settled a longstanding dispute, and agreed to develop software where Chase customers send their data, for financial purposes, to Mint without having Intuit store customers' names and passwords. Some banks support a separate "access code" for read-only access to financial information, which reduces the risk to some degree. This has raised concerns that if the Mint databases were ever hacked, both user names and passwords would become available to rogue third parties. Mint asks users to provide both the user names and the passwords to their bank accounts, credit cards, and other financial accounts, which Mint then stores in their databases in a decryptable format. Patzer further added the features of the online product would be incorporated into the Intuit's Quicken desktop product, and vice versa, as two collaborative aspects of the Intuit Personal Finance team. The former CEO of, Aaron Patzer, was named vice president and general manager of Intuit’s personal finance group, responsible for and all Quicken online, desktop, and mobile offerings. On November 2, 2009, Intuit announced their acquisition of was complete. An official announcement was made the following day. On September 13, 2009, TechCrunch reported Intuit would acquire Mint for $170 million. In February 2008, revenue was generated through lead generation, earned via earning referral fees from recommendations of highly personalized, targeted financial products to its users. TechCrunch later pegged the valuation of Mint at $140M. The latest round of $14M was closed on August 4, 2009, and reported by CEO Aaron Patzer as preemptive. Mint raised over $31M in venture capital funding from DAG Ventures, Shasta Ventures, and First Round Capital, as well as from angel investors including Ram Shriram, an early investor in Google. In 2016, claimed to have over 20 million users. Īs of 2010, claimed to connect with more than 16,000 US and Canadian financial institutions, and to support more than 17 million individual financial accounts. Mint's primary service allows users to track bank, credit card, investment, and loan balances and transactions through a single user interface, as well as create budgets and set financial goals. It was later renamed from "" to just "Mint". was originally created by Aaron Patzer and provided account aggregation through a deal with Yodlee, but switched to using Intuit's own system for connecting to accounts after it was purchased by Intuit in 2009.

(which also produces TurboTax, QuickBooks, and Credit Karma). Mint, also known as Intuit Mint (styled in its logo as intuit mint with dotted 't' characters in "intuit" and undotted 'i' characters) and formerly known as, is a personal financial management website and mobile app for the US and Canada produced by Intuit, Inc.

0 kommentar(er)

0 kommentar(er)